city of richmond property tax bill

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. Tax bills are mailed in the month of July.

Rps To Discuss River City Middle Rezoning

How to read your Property Tax Bill See bill example to know How to Read Your Property Tax Bill.

. The City of Richmonds fiscal year is July 1 through June 30. 1 day agoUnder the proposal Henrico would effectively reduce the personal property tax rate by 52 cents for the year from 350 to 298 per 100 of assessed value. The exact amount of money returned to.

Welcome to the Tax Online Payment Service. Only the registered property owner is allowed to change the mailing address. This service allows you to make a tax bill payment for a specific property within your Municipality.

Personal Property Taxes are billed once a year with a December 5 th due date. To begin please enter the appropriate information in one of the searches below. The City of Richmond is authorized by state law to levy taxes on real property in the city of Richmond.

Tax bills are mailed in the month of July. Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in order of median property taxes. Parking tickets can now be paid online.

Call 804 646-7000 or send an email to the Department of Finance. Taxpayer Property Account Information. 300 flat fee for any amount 10000 and UNDER.

Property values are determined by the City Assessor and the Department of Finance issues the tax bills based on the valuation information provided by the Assessors Office. 1000 flat fee for any amount OVER 10000. All late payments accrue interest.

Failure to receive a tax bill does not relieve you of the penalty and the interest on a past due bill. Demystifying Property Tax Apportionment httpstaxcolpcocontra-costacaustaxpaymentrev3summaryaccount_lookupjsp. City of Richmond adopted a tax rate.

Create an Account - Increase your productivity customize your experience and engage in information you care about. Please note that failure to receive a tax bill does not negate the requirement to pay the tax. Real Estate taxes are assessed as of January 1 st of each year.

Bills paid after November 15th will incur interest charges. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. To pay your Tax Bill online simply click here Online Tax Bill Payments.

Personal Property Registration Form An ANNUAL filing is required on all. To pay your Water Bill online simply click here Online Water Bill Payments. Pay Your Parking Violation.

Broad St Rm 802 Richmond. Look at your property tax invoices attending to the history and summary presented. Tax Bill General Information.

Tax bills are mailed out on July 1st and December 1st and are due on September 30th and February 28th. To begin please enter the appropriate information in one of the searches below. Residents are invited to attend the annual budget hearings in April and May of each year.

Personal Property Taxes are billed once a year with a December 5 th due date. Real Estate and Personal Property Taxes Online Payment. Late payment penalty of 10 is applied on December 6 th.

Disabled Veterans or their surviving spouses who believe they may be eligible for the real. Search by Parcel IDMap Reference Number. Ad Find Out the Market Value of Any Property and Past Sale Prices.

Performs such other duties as prescribed by law the City Council or the City Manager. Please correct the errors and try again. Richmond City Assessors Office 900 E.

From the drop-down menu select the option to view your property tax bill. Parking Violations Online Payment. If you do not receive a bill it is your responsibility to investigate whether you have a liability to the Town.

Look through your actual property tax bill. Partial Parcel ID may be entered but at least 8 digits should be entered in order to activate the auto suggestion. The interim tax bills are mailed in january of each year with instalments due in march and may.

Understanding Your Tax Bill. Residential and commercial property owners will receive a tax bill including their property tax rates property assessment and class and payment dates and deadlines. Click Here to Pay Parking Ticket Online.

Business License - City of Richmond Instructions for Business License Online Payments httpsetrakitcirichmondcaus Parking Tickets - T2 Systems https. Interest is assessed as of january 1 st at a rate of 10 per year. Collection of Taxes for Other Taxing Authorities.

Find and visit the website of the New York City Department of Finance. Billing is on annual basis and payments are due on December 5 th of each year. Property owners are responsible for making sure that they receive their tax bills and for making the required payments on time.

Residential and commercial property owners will receive a tax bill including their property tax rates property assessment and class and payment dates and deadlines. This utility allows a person to interactively search the City of Richmond real property database on criteria such as Parcel ID Address Land Value Consideration Amount etc. Taxpayers who pay within the first 20 days on or by Sept.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. 30 2021 will receive a 1 discount on the tax portion of their bill a perk that is shared by only a few counties in Georgia. 3 of total amount minimum of 200.

For commercial tenants wanting to change the mailing address of a utility bill contact the City of Richmond Tax Department at 604-276-4145 or TaxDeptrichmondca. City of richmond property tax bill. The propertys Parcel ID should be entered such as W0210213002.

All property owners in Richmond Hill must pay their property taxes. Team Papergov 1 year ago. Tax bills which are usually mailed in mid-September will retain their same due date of November 15th.

For example entering W0210213 will display the list of all Parcel IDs starting with. If you are disputing the assessment of your tax you are required to. City of Richmond City Hall 402 Morton Street Richmond TX 77469 281 342-5456.

3 Road Richmond British Columbia V6Y 2C1 Hours. Richmond City collects on average 105 of a propertys assessed fair market value as property tax. 12 hours agoFrustrations rise in Henrico as personal property tax bills increase Virginia lawmakers react to report suggesting Supreme Court will overturn abortion rights Jury awards 15M in damages in UVA.

City of Richmond Macomb County. This will change your mailing address for your Property Assessment Notice Property Tax Notice and your Utility Bills. Interest is assessed as of January 1 st at a rate of 10 per year.

Personal property taxes are billed annually with a due date of december 5 th. 815 am to 500 pm Monday to Friday.

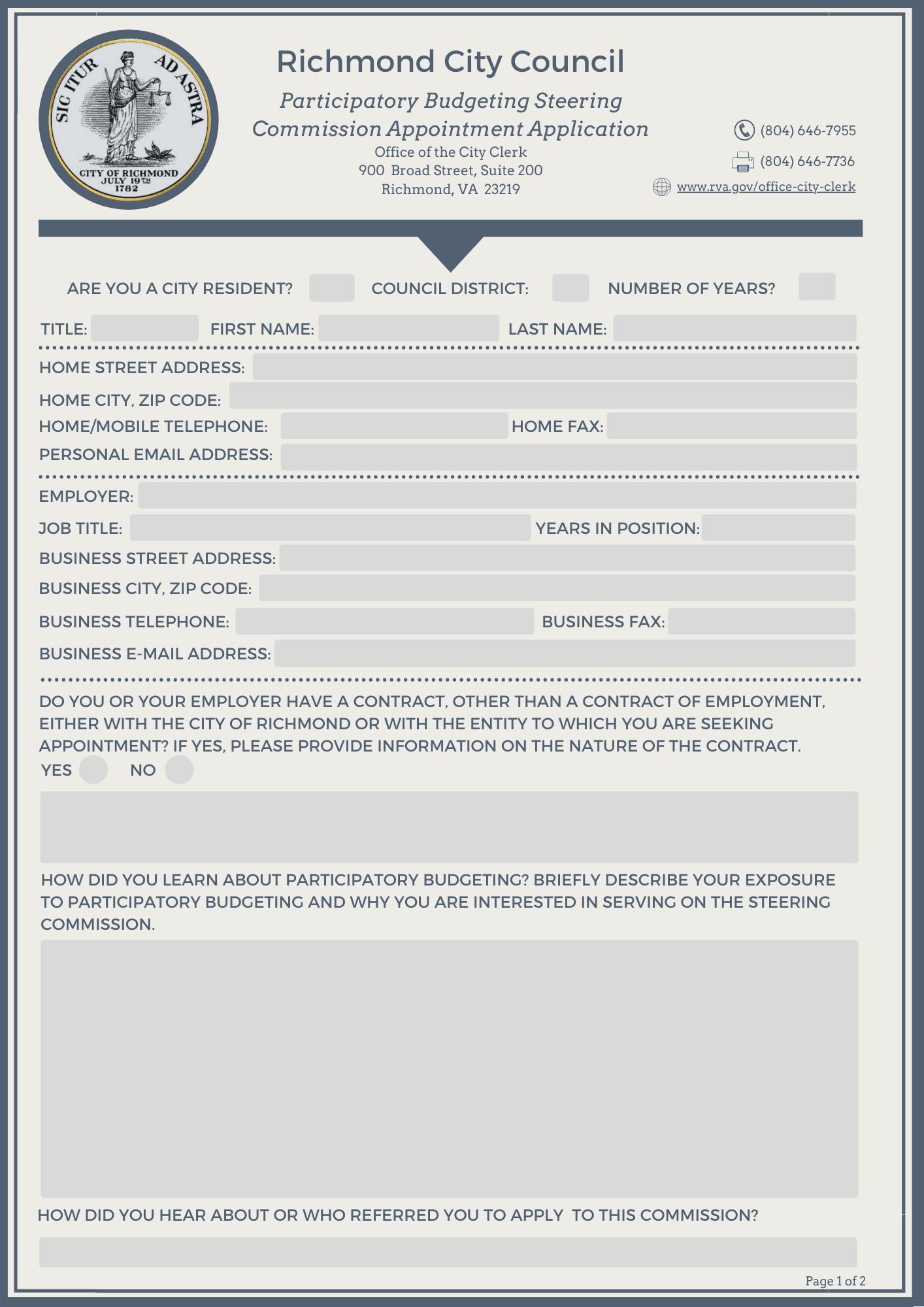

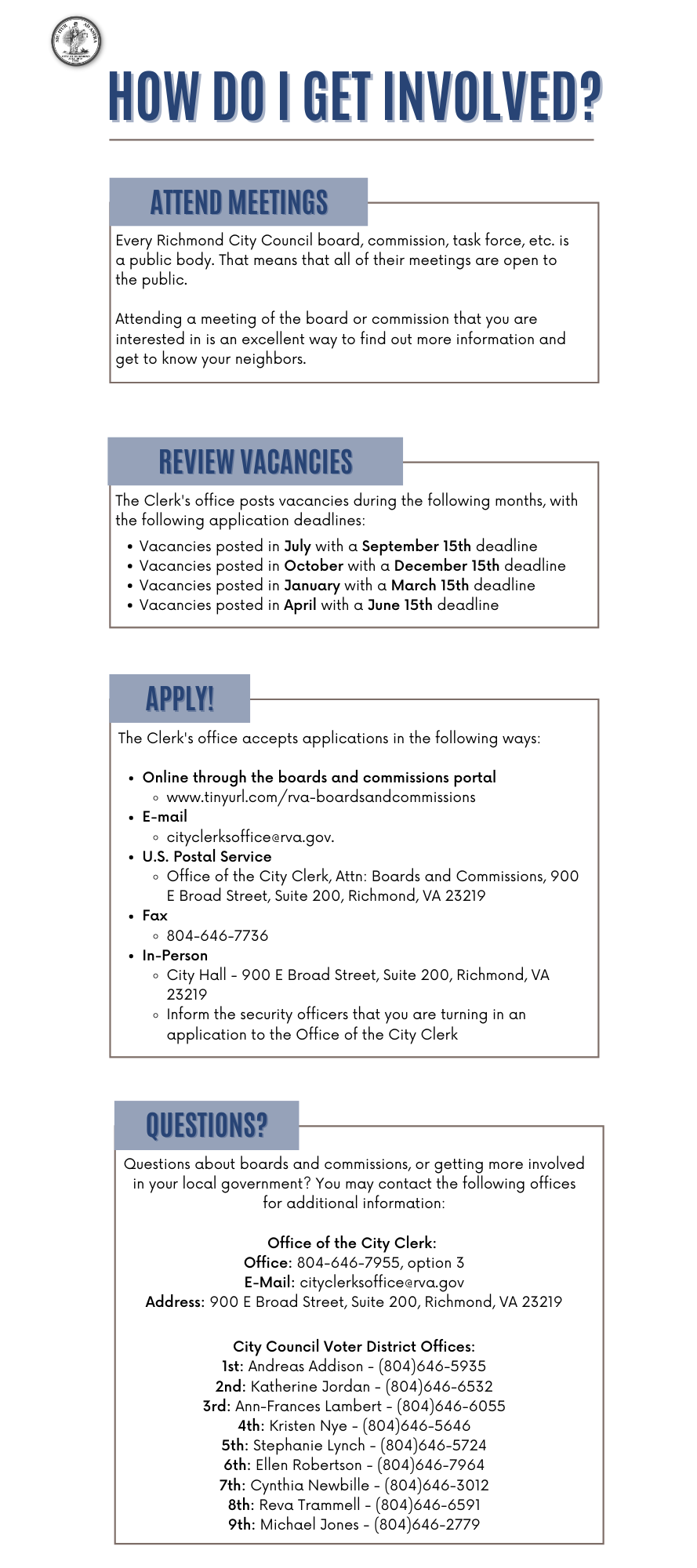

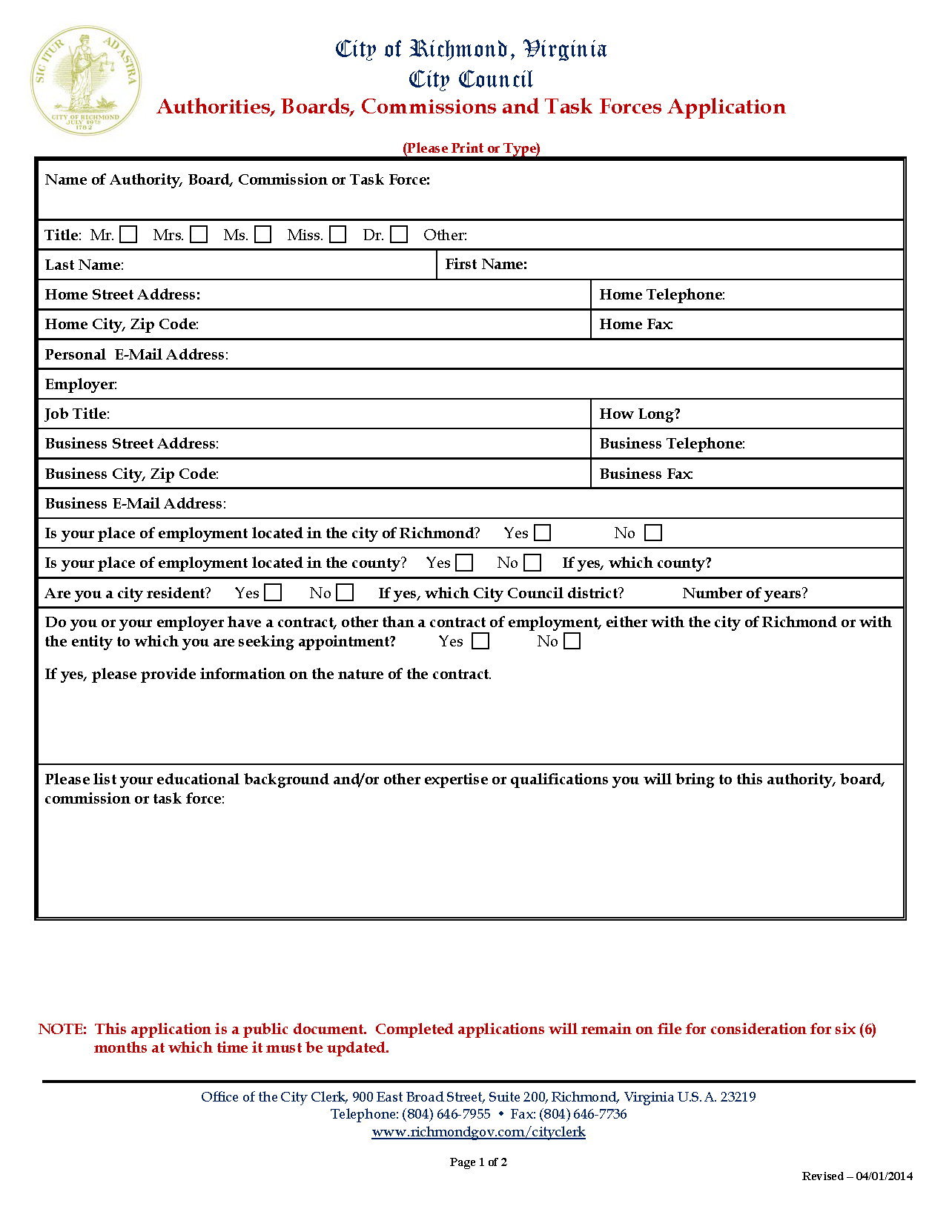

Boards And Commissions Richmond

Richmond Virginia Va Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Building Department City Of Richmond

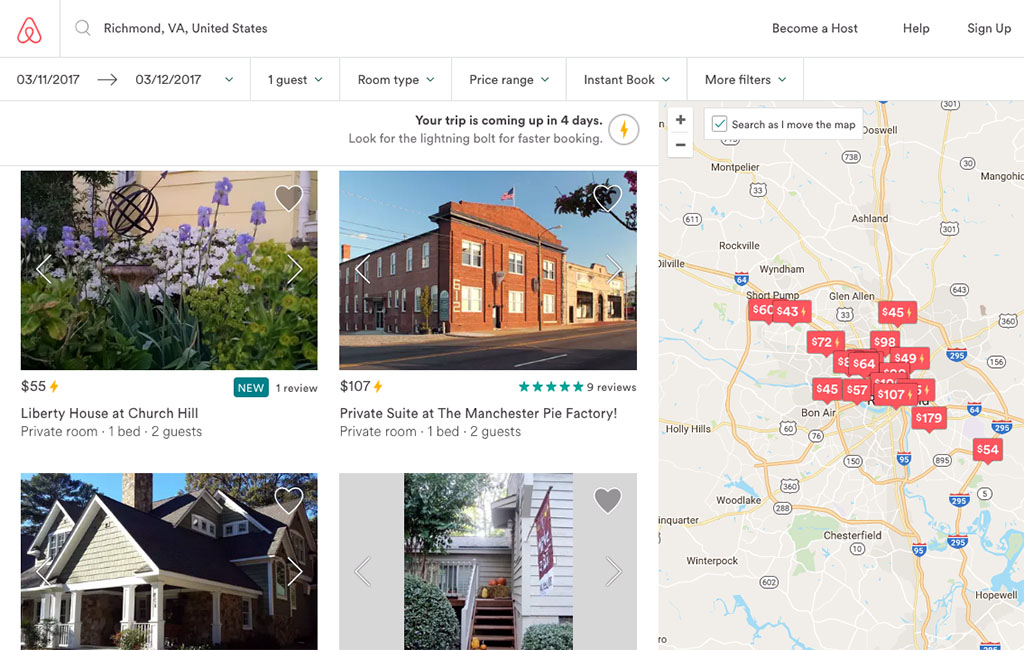

Richmond Delays Revisiting Airbnb Style Home Rental Rules Until January Richmond Bizsense

Paul S Later The Village Cafe 939 W Grace St Ca 1925 Richmond Va Richmond Richmond Virginia

Richmond Virginia Va Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Boards And Commissions Richmond

6th Annual Art Walk Motor Madness Calendar City Of Richmond

Boards And Commissions Richmond

Customary Closing Costs In Northern California Caliliving Calilifestyle Carealestate Realestate Homebuyi California Real Estate California Closing Costs

Service After Sale The Houston Region To All Of My Buyers Request To Correct Name Or Address On A Real Property Accoun Harris County Tax Forms Accounting

3455 Fleetwood Drive Richmond Contra Costa County Ca Compass In Ground Pools Fleetwood Gas City

Future Of Homeless People Living In Richmond Tent City In Question

Municipal Court City Of Richmond

Formerly Redlined Areas Of Richmond Are Going Green Chesapeake Bay Foundation