can i get a mortgage loan owing back taxes

When lenders look at your. Because of the effects on your debt-to-income ratio it can be tough to get a mortgage loan when you owe money to the IRS can be difficult.

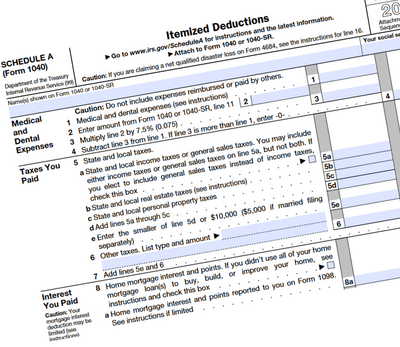

Are My Tax Returns Required For An Fha Loan

But youll need to go through a manual underwriting process to make this.

. Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans. Start Planning Your Retirement Contact Us. Owing taxes or having a tax lien does make it harder and more complicated to get a mortgage.

Owing back taxes isnt an automatic deal-breaker when you apply for a Federal Housing Administration FHA mortgage. See What You Can Afford. Ad With 55 Million Loan Requests LendingTree Knows How To Help You Find A Loan.

2 If you have a history of making payments on your IRS back taxes for 12 months without any late payments then you can get a mortgage with me assuming you qualify. Capitalize On Our Low Rates For Cali Residents - View Various Refi Options - Call Today. Ad Compare Top Mortgage Lenders 2022.

As long as youre paying off your debt the fact that. Can you get an FHA loan if you owe back taxes. Ad As One Of The Nations Leading Financial Lenders We Can Help.

Yes you might be able to get a home loan even if you owe taxes. If youre looking to get a mortgage and have unpaid tax debt the worst thing you can do is ignore it. If you owe a little bit in taxes because of some mishaps but intend to pay them promptly late penalties and all youll have less of a problem acquiring a mortgage than.

They do not want to loan money to. You can qualify for a home mortgage with outstanding unpaid taxes to the Internal Revenue Service. View Ratings of the Best Mortgage Lenders.

With some careful planning you can. Simplify Your Home Loan Search with the Help of LendingTree. Ad Pick A Mortgage Option That Fits - Apply Today For The Last Refinance You May Ever Need.

Owing federal tax debt makes it harder to get approved for a mortgage but its not impossible to get a home loan with this debt factored in. Fannie Mae clears the way Mortgage giant Fannie Mae sent out an update today to its lenders allowing them to approve applicants who owe back taxes. If you owe back taxes previous years- not 2019 and they are subject to a lien then you must have a payment arrangement in place and have made 3 payments before.

Yes you may be able to get an FHA loan even if you owe tax debt. Can I get an FHA home loan if I owe back taxes. Ad Realize Your Dream of Having Your Own Home.

Ad Best Home Lenders Compared Reviewed. Mortgage lenders realize the risks that come with owing the IRS money and what measures this federal agency can use to recoup outstanding tax balances. If you dont have a payment plan or settlement set.

Get Free Quotes From Reputable Lenders. A Top Reverse Mortgage Lender For Many Years. Compare Rates of Interest Down Payment Needed in Seconds.

However HUD the parent of FHA allows borrowers with outstanding federal. The answer to this question depends on more than one factor the most important being whether or not the borrower is. A Top Reverse Mortgage Lender For Many Years.

Ad As One Of The Nations Leading Financial Lenders We Can Help. The change is effective. Tax Debt and Home Loans.

Start Planning Your Retirement Contact Us. Apply for Your Mortgage Now.

Irs Form 4506 Sounds Harmless Enough 4506 T Mortgage Getloans Com

Mortgages 101 Your One Stop Blog For Mortgage Terminology Debt To Income Ratio Loan Money Mortgage Basics

Can You Qualify For A Usda Mortgage With An Irs Tax Lien Or Repayment Plan Usda Loan Pro

A Little Laugh For Your Day Why Was The Irs After The Chiropractor He Owed Back Taxes Jason Carr Law Office Cards

Can You Get A Mortgage If You Owe Back Taxes To The Irs

2022 No Tax Return Mortgage Options Easy Approval

How Does A Refinance In 2021 Affect Your Taxes Hsh Com

Can You Get A Mortgage If You Owe Back Taxes To The Irs

The Do S Don Ts When Applying For A Home Loan Mortgage Payoff Mortgage Tips Paying Off Mortgage Faster